Australia's financial crime compliance costs reach $5.37bn

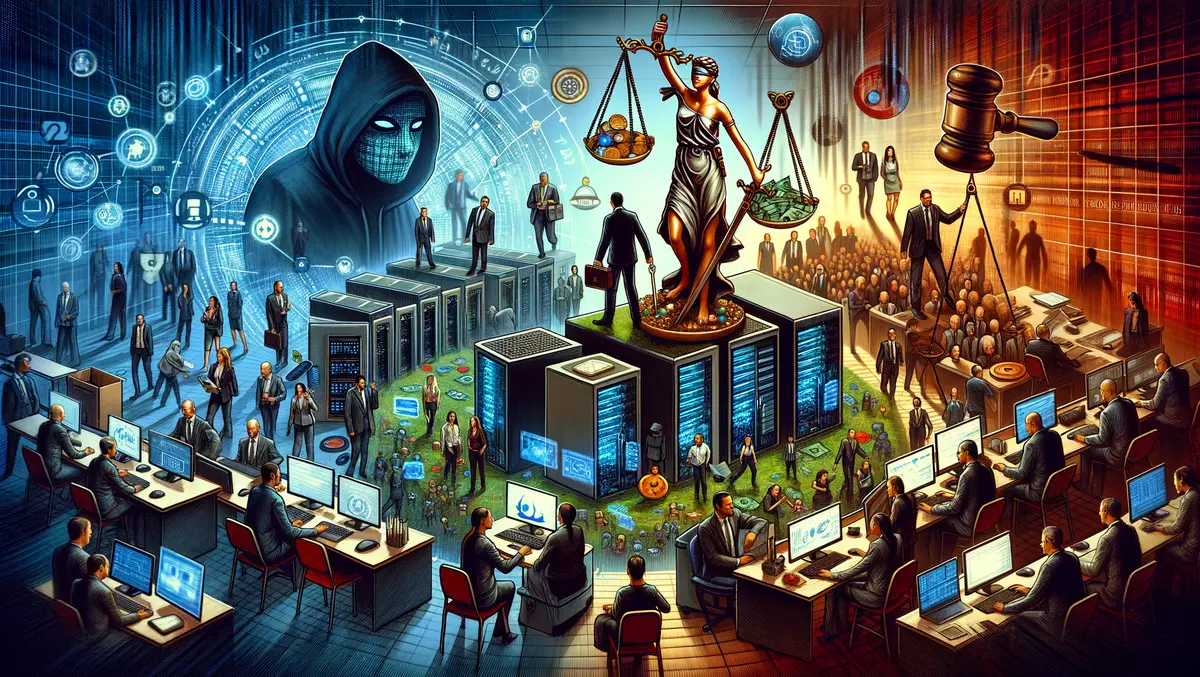

The latest annual 'True Cost of Financial Crime Compliance' report, released by LexisNexis Risk Solutions, reveals that the total financial crime compliance costs in Australia amounted to AU$5.37 billion (US$3.5 billion). Almost all financial institutions (98%) have reported an increase in costs. The study indicates that financial institutions in Australia spend the highest proportion of their budgets, 34%, on technology relative to other surveyed countries, whilst labour and resource costs account for 39% of expenditure.

The survey witnessed financial institutions reporting significant increases of more than 20% in particular types of financial crime over the past 12 months. Of the institutions surveyed, 23% identified instances of financial crime involving the use of cryptocurrencies and 23% documented a heightened use of artificial intelligence.

The data from Australia forms part of the wider 'True Cost of Financial Crime Compliance Study – Asia Pacific,' conducted by Forrester Consulting. The study revealed that financial crime compliance costs have escalated for 98% of financial institutions during the 2023 timeframe. The total cost for Asia Pacific region countries surveyed has risen to U.S.$45 billion.

Significantly, 81% of financial institutions surveyed are focussing on compliance programme cost reduction over the next 12 months. Concerning factors contributing to the escalation of costs; 39% of the institutions involved in the study identified heightened financial crime regulations and regulatory expectations as a principal driver.

The study also highlighted that managing an increasingly complex sanctions environment is propelling institutions to cope with larger screening workloads, leading to a rise in screening alerts at 79% of organisations.

According to the study's key findings, technology costs are fuelling expenditure rises for financial institutions. It underscores the substantial investment needed to fulfil stringent compliance requirements. Specifically, compliance and Know-Your-Customer software related technology costs have seen an upsurge in 70% of organisations, whilst 74% are registering cost increases associated with network and remote work technologies.

Labor costs have been cited as a primary driver of cost escalation by 75% of Asia Pacific institutions surveyed. The study stresses the importance of investment in highly qualified compliance professionals to effectively fulfil stringent compliance requirements.

Matt Michaud, Global Head of Financial Crime Compliance at LexisNexis Risk Solutions, commented on the findings, "Skilled in-house compliance teams are essential, but businesses should be actively seeking ways to reduce labour costs while improving compliance efficiency. Criminals adapt quickly and FIs require a partner with advanced tools, data, and analytics to not only keep pace but to stay ahead."

The report advised that financial institutions could strike a balance between customer experience and financial crime compliance efficiency to achieve compliance effectiveness. It suggests embracing new technologies to counter emerging financial crimes and advocates the use of compliance tools and analytics to manage costs and boost efficiency.